HMDA Data

Mortgage Loan Stats

Mortgage Lending Data and Mortgage Application Totals

by Lender, City, State, and More

Looking for mortgage loan data and lending statistics by lender or geographic area? Look no further. Our full database has all the national statistics on mortgages. Here, you will be able to find mortgage data totaled by lender, city, county, state, metro area, and more.

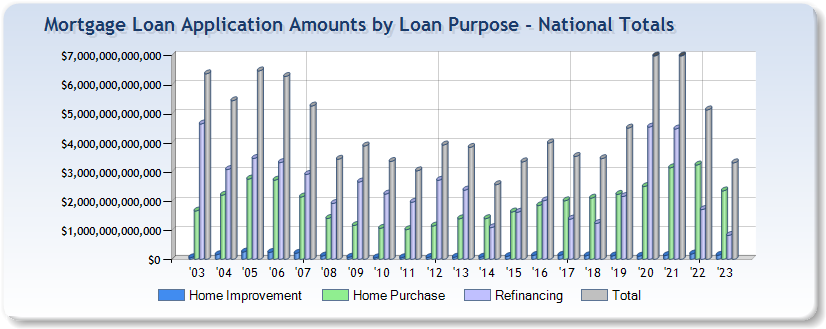

Mortgage Loan Application Amounts by Loan Purpose

| Year | Home Improvement | Home Purchase | Refinancing | Total |

|---|---|---|---|---|

| 2003 | $58,142,407,000 | $1,665,300,366,000 | $4,661,923,190,000 | $6,385,365,963,000 |

| 2004 | $161,130,209,000 | $2,209,078,897,000 | $3,090,693,585,000 | $5,460,902,691,000 |

| 2005 | $251,008,318,000 | $2,762,751,074,000 | $3,472,824,190,000 | $6,486,583,582,000 |

| 2006 | $239,109,985,000 | $2,727,108,595,000 | $3,328,995,803,000 | $6,295,214,383,000 |

| 2007 | $209,256,206,000 | $2,147,638,464,000 | $2,922,288,616,000 | $5,279,183,286,000 |

| 2008 | $116,194,949,000 | $1,407,704,803,000 | $1,922,336,739,000 | $3,446,236,491,000 |

| 2009 | $73,426,585,000 | $1,166,427,575,000 | $2,662,355,908,000 | $3,902,210,068,000 |

| 2010 | $54,766,173,000 | $1,068,629,592,000 | $2,246,763,391,000 | $3,370,159,156,000 |

| 2011 | $58,759,110,000 | $1,023,717,029,000 | $1,965,578,208,000 | $3,048,054,347,000 |

| 2012 | $66,978,456,000 | $1,149,372,476,000 | $2,721,162,125,000 | $3,937,513,057,000 |

| 2013 | $74,193,149,000 | $1,396,667,024,000 | $2,384,257,034,000 | $3,855,117,207,000 |

| 2014 | $75,814,827,000 | $1,402,434,368,000 | $1,093,125,735,000 | $2,571,374,930,000 |

| 2015 | $101,915,080,000 | $1,633,245,684,000 | $1,621,342,219,000 | $3,356,502,983,000 |

| 2016 | $135,206,200,000 | $1,850,962,309,000 | $2,018,361,845,000 | $4,004,530,354,000 |

| 2017 | $140,430,292,000 | $2,016,148,093,000 | $1,386,169,223,000 | $3,542,747,608,000 |

| 2018 | $122,589,995,000 | $2,108,089,055,000 | $1,237,365,535,000 | $3,468,044,585,000 |

| 2019 | $118,572,755,000 | $2,236,279,660,000 | $2,164,412,115,000 | $4,519,264,530,000 |

| 2020 | $106,605,240,000 | $2,505,455,885,000 | $4,553,756,405,000 | $7,165,817,530,000 |

| 2021 | $131,615,690,000 | $3,152,109,455,000 | $4,488,134,135,000 | $7,771,859,280,000 |

These statistics will give you an overview of the housing market nationally and in your area. The information we provide about mortgage loan amounts can help you understand the amount of lending and lender activity in your area. There are so many numbers to look at when finding a mortgage and deciding what your loan payment will be like, but our graphs and charts provide the most comprehensive overview to get you started with as little stress as possible.

As the real estate market is now on a rebound in most areas, searching through the history of mortgage stats in the US will give you a better idea of the market and mortgage lenders. Knowing these numbers in advance will give you an advantage when meeting with a mortgage lender, and may help you get a better loan price.

If you're trying to find the best mortgage lender in your area, you don't have to worry about searching through hundreds of sites of data. Here at AllMortgageDetail, we have lending statistics on lenders and geographic areas from 2003-2021. You can find the best lenders by searching our mortgage lenders index.

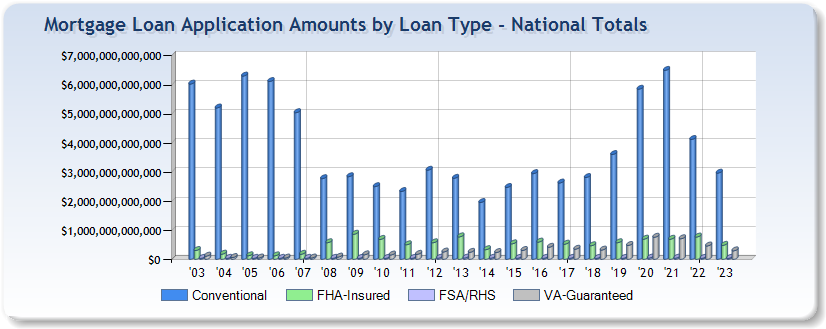

Mortgage Loan Application Amounts by Loan Type

| Year | Conventional | FHA-insured | FSA/RHS | VA-guaranteed |

|---|---|---|---|---|

| 2003 | $6,034,139,176,000 | $304,489,424,000 | $4,481,342,000 | $112,401,875,000 |

| 2004 | $5,211,325,770,000 | $181,502,417,000 | $4,189,243,000 | $63,885,261,000 |

| 2005 | $6,309,164,175,000 | $124,730,672,000 | $4,144,454,000 | $48,544,281,000 |

| 2006 | $6,121,488,485,000 | $122,866,962,000 | $3,941,992,000 | $46,916,944,000 |

| 2007 | $5,049,106,555,000 | $175,661,784,000 | $5,594,074,000 | $48,820,873,000 |

| 2008 | $2,779,202,758,000 | $573,624,789,000 | $13,414,741,000 | $79,994,203,000 |

| 2009 | $2,845,590,059,000 | $865,826,708,000 | $33,634,247,000 | $157,159,054,000 |

| 2010 | $2,503,386,134,000 | $688,496,262,000 | $28,272,176,000 | $150,004,584,000 |

| 2011 | $2,335,163,205,000 | $502,786,386,000 | $36,044,520,000 | $174,060,236,000 |

| 2012 | $3,068,939,728,000 | $571,506,171,000 | $43,778,960,000 | $253,288,198,000 |

| 2013 | $2,789,120,631,000 | $775,467,935,000 | $46,787,494,000 | $243,741,147,000 |

| 2014 | $1,957,454,240,000 | $334,461,583,000 | $43,940,337,000 | $235,518,770,000 |

| 2015 | $2,475,607,499,000 | $535,707,199,000 | $37,848,952,000 | $307,339,333,000 |

| 2016 | $2,952,021,534,000 | $596,524,811,000 | $38,305,894,000 | $417,678,115,000 |

| 2017 | $2,628,618,865,000 | $524,274,311,000 | $39,081,502,000 | $350,772,930,000 |

| 2018 | $2,816,918,570,000 | $471,203,970,000 | $32,381,925,000 | $321,129,555,000 |

| 2019 | $3,608,464,395,000 | $573,645,220,000 | $31,981,880,000 | $479,329,210,000 |

| 2020 | $5,856,352,540,000 | $696,539,025,000 | $46,574,725,000 | $762,512,810,000 |

| 2021 | $6,503,477,395,000 | $694,578,895,000 | $42,590,140,000 | $710,924,790,000 |

Top 25 Counties by Mortgage Loan Application Count in 2021

| County | Total Number of Mortgage Loan Applications | Total Mortgage Loan Application Amount | Average Mortgage Loan Application Amount | Average Applicant Income |

|---|---|---|---|---|

| Santa Clara County California |

170,430 | $121,803,060,000 | $714,000 | $245,000 |

| San Mateo County California |

65,404 | $51,690,040,000 | $790,000 | $266,000 |

| San Francisco County California |

50,229 | $40,389,685,000 | $804,000 | $284,000 |

| Westchester County New York |

47,292 | $24,346,750,000 | $514,000 | $239,000 |

| New York County New York |

36,039 | $42,065,440,000 | $1,167,000 | $462,000 |

| Marin County California |

26,787 | $20,657,115,000 | $771,000 | $282,000 |

| Walton County Florida |

14,935 | $7,386,645,000 | $494,000 | $258,000 |

| Monroe County Florida |

8,824 | $5,069,440,000 | $574,000 | $270,000 |

| Summit County Utah |

8,134 | $6,188,260,000 | $760,000 | $351,000 |

| Summit County Colorado |

7,362 | $4,076,700,000 | $553,000 | $264,000 |

| Eagle County Colorado |

7,298 | $5,046,250,000 | $691,000 | $273,000 |

| Wasatch County Utah |

5,516 | $2,996,030,000 | $543,000 | $231,000 |

| Blaine County Idaho |

3,032 | $1,768,000,000 | $583,000 | $247,000 |

| Dukes County Massachusetts |

2,761 | $2,067,805,000 | $748,000 | $344,000 |

| Pitkin County Colorado |

2,499 | $4,335,635,000 | $1,734,000 | $572,000 |

| Mono County California |

2,485 | $1,047,895,000 | $421,000 | $292,000 |

| Teton County Wyoming |

2,136 | $2,668,550,000 | $1,249,000 | $455,000 |

| Nantucket County Massachusetts |

1,852 | $2,362,520,000 | $1,275,000 | $528,000 |

| Falls Church County Virginia |

1,276 | $724,310,000 | $567,000 | $254,000 |

| San Miguel County Colorado |

1,155 | $1,003,085,000 | $868,000 | $371,000 |

| Madison County Montana |

1,143 | $1,324,845,000 | $1,159,000 | $488,000 |

| Dorado County Puerto Rico |

843 | $436,215,000 | $517,000 | $329,000 |

| Alpine County California |

250 | $94,120,000 | $376,000 | $310,000 |

| Hinsdale County Colorado |

137 | $42,645,000 | $311,000 | $245,000 |

| Schleicher County Texas |

41 | $6,925,000 | $168,000 | $300,000 |

Top 25 Metro Areas by Mortgage Loan Application Count in 2021

| Metro Area | Total Number of Mortgage Loan Applications | Total Mortgage Loan Application Amount | Average Mortgage Loan Application Amount | Average Applicant Income |

|---|---|---|---|---|

| NEW YORK-JERSEY CITY-WHITE PLAINS, NY-NJ | 402,210 | $228,743,530,000 | $6,008,666 | $195,000 |

| DENVER-AURORA-LAKEWOOD, CO | 392,417 | $144,422,425,000 | $6,869,000 | $293,000 |

| SEATTLE-BELLEVUE-EVERETT, WA | 319,244 | $154,505,890,000 | $5,445,500 | $219,500 |

| OAKLAND-HAYWARD-BERKELEY, CA | 289,249 | $162,298,090,000 | $1,326,000 | $235,000 |

| BALTIMORE-COLUMBIA-TOWSON, MD | 264,224 | $81,751,945,000 | $1,085,500 | $203,500 |

| NEW YORK-NEWARK, NY | 256,655 | $85,582,870,000 | $1,222,666 | $179,333 |

| NASSAU COUNTY-SUFFOLK COUNTY, NY | 181,486 | $82,001,760,000 | $6,936,500 | $192,000 |

| SAN JOSE-SUNNYVALE-SANTA CLARA, CA | 178,043 | $125,530,025,000 | $703,500 | $200,500 |

| MIAMI-MIAMI BEACH-KENDALL, FL | 162,076 | $63,873,460,000 | $394,000 | $172,000 |

| WEST PALM BEACH-BOCA RATON-DELRAY BEACH, FL | 128,447 | $47,321,720,000 | $20,356,500 | $170,000 |

| SAN FRANCISCO-REDWOOD CITY-SOUTH SAN FRANCISCO, CA | 115,633 | $92,079,725,000 | $796,000 | $274,000 |

| GRAND RAPIDS-WYOMING, MI | 89,876 | $18,081,740,000 | $5,077,500 | $380,500 |

| BRIDGEPORT-STAMFORD-NORWALK, CT | 72,918 | $36,185,100,000 | $13,218,000 | $220,000 |

| VALLEJO-FAIRFIELD, CA | 48,767 | $18,451,105,000 | $448,000 | $207,000 |

| NAPLES-IMMOKALEE-MARCO ISLAND, FL | 43,203 | $17,509,815,000 | $405,000 | $204,000 |

| BARNSTABLE TOWN, MA | 30,191 | $11,090,225,000 | $367,000 | $186,000 |

| SALINAS, CA | 27,589 | $13,598,435,000 | $518,500 | $260,500 |

| BEND-REDMOND, OR | 27,488 | $10,254,470,000 | $714,000 | $245,000 |

| SAN RAFAEL, CA | 26,787 | $20,657,115,000 | $771,000 | $282,000 |

| CORPUS CHRISTI, TX | 24,126 | $5,321,525,000 | $2,727,000 | $179,500 |

| SANTA CRUZ-WATSONVILLE, CA | 21,555 | $11,621,405,000 | $552,000 | $200,500 |

| OCEAN CITY, NJ | 17,667 | $7,272,710,000 | $411,000 | $230,000 |

| TUSCALOOSA, AL | 16,134 | $3,363,530,000 | $601,500 | $170,000 |

| KAHULUI-WAILUKU-LAHAINA, HI | 13,161 | $7,092,425,000 | $632,500 | $277,000 |

| NAPA, CA | 12,171 | $6,620,055,000 | $543,000 | $207,000 |

Top 50 Mortgage Companies and Lenders by Loan Application Count in 2021

| Mortgage Lender | Total Number of Mortgage Loan Applications | Total Dollar Amount of Mortgage Loan Applications | Average Mortgage Loan Application Amount | Average Applicant Income |

|---|---|---|---|---|

| Wells Fargo Bank, National Association Winston-Salem, NC |

897,196 | $320,396,800,000 | $320,000 | $167,800 |

| United Shore Financial Services, Llc Troy, MI |

803,496 | $281,022,410,000 | $326,500 | $124,666 |

| Freedom Mortgage Corporation Fishers, IN |

739,580 | $184,714,260,000 | $238,400 | $99,333 |

| Pennymac Loan Services, Llc Westlake Village, CA |

590,862 | $164,069,930,000 | $266,500 | $117,500 |

| Loandepot.Com, Llc Foothill Ranch, CA |

558,593 | $190,096,175,000 | $263,600 | $114,750 |

| Jpmorgan Chase Bank, National Association Columbus, OH |

546,394 | $246,168,330,000 | $481,000 | $204,400 |

| Newrez Llc Plymouth Meeting, PA |

529,874 | $143,417,445,000 | $291,200 | $126,400 |

| U.S. Bank National Association Cincinnati, OH |

492,078 | $146,235,715,000 | $233,500 | $158,800 |

| Amerisave Mortgage Corporation Atlanta, GA |

486,974 | $128,757,890,000 | $276,666 | $109,666 |

| Nationstar Mortgage Llc Coppell, TX |

402,748 | $103,387,330,000 | $225,666 | $103,000 |

| Caliber Home Loans, Inc. Coppell, TX |

400,596 | $117,593,630,000 | $266,250 | $106,250 |

| Bank Of America, National Association Westlake Village, CA |

368,728 | $137,418,605,000 | $335,500 | $164,500 |

| Home Point Financial Corporation Ann Arbor, MI |

342,452 | $116,901,600,000 | $299,333 | $124,000 |

| Fairway Independent Mortgage Corporation Madison, WI |

326,921 | $98,649,275,000 | $265,666 | $117,000 |

| Guaranteed Rate, Inc. Chicago, IL |

319,880 | $120,531,090,000 | $373,333 | $153,000 |

| Amerihome Mortgage Company, Llc Woodland Hills, CA |

300,026 | $85,463,910,000 | $260,500 | $113,000 |

| Truist Bank Raleigh, NC |

282,248 | $79,995,480,000 | $226,500 | $125,000 |

| Lakeview Loan Servicing, Llc Coral Gables, FL |

279,812 | $70,332,390,000 | $289,600 | $56,600 |

| Citizens Bank, National Association Providence, RI |

273,341 | $69,455,525,000 | $217,000 | $129,200 |

| Better Mortgage Corporation New York, NY |

242,544 | $85,554,250,000 | $334,750 | $152,750 |

| Cardinal Financial Company, Limited Partnership Charlotte, NC |

231,880 | $63,851,915,000 | $276,333 | $116,666 |

| Mortgage Research Center, Llc Columbia, MO |

223,183 | $63,022,705,000 | $274,333 | $96,333 |

| Crosscountry Mortgage, Inc. Brecksville, OH |

220,540 | $73,404,860,000 | $302,200 | $130,600 |

| Flagstar Bank, Fsb Troy, MI |

212,842 | $65,949,410,000 | $253,600 | $133,800 |

| Broker Solutions, Inc. Tustin, CA |

190,426 | $55,603,460,000 | $292,750 | $108,250 |

| 21St Mortgage Corporation Knoxville, TN |

179,953 | $18,183,735,000 | $61,666 | $63,000 |

| Navy Federal Credit Union Vienna, VA |

175,240 | $51,733,730,000 | $242,166 | $128,400 |

| Pnc Bank, National Association Pittsburgh, PA |

173,932 | $54,605,895,000 | $286,600 | $166,800 |

| Guild Mortgage Company San Diego, CA |

167,037 | $47,245,940,000 | $294,000 | $99,500 |

| Movement Mortgage, Llc Indian Land, SC |

149,914 | $44,187,890,000 | $292,000 | $114,750 |

| Fifth Third Bank, National Association Cincinnati, OH |

145,301 | $29,479,435,000 | $166,000 | $112,800 |

| The Huntington National Bank Columbus, OH |

144,028 | $29,826,600,000 | $176,166 | $115,833 |

| Vanderbilt Mortgage And Finance, Inc. Maryville, TN |

128,354 | $15,656,970,000 | $179,250 | $90,500 |

| New Day Financial, Llc Fulton, MD |

119,826 | $30,188,920,000 | $232,250 | $79,000 |

| Discover Bank New Castle, DE |

119,817 | $10,403,425,000 | $99,250 | $119,000 |

| Regions Bank Birmingham, AL |

116,367 | $22,846,900,000 | $181,800 | $121,000 |

| Cmg Mortgage, Inc. San Ramon, CA |

107,604 | $35,111,620,000 | $320,400 | $120,600 |

| Finance Of America Mortgage Llc Horsham, PA |

105,457 | $39,410,655,000 | $358,400 | $155,600 |

| Phh Mortgage Corporation Mt Laurel, NJ |

104,550 | $28,807,450,000 | $269,750 | $77,500 |

| Primelending, A Plainscapital Company Dallas, TX |

103,258 | $30,236,760,000 | $260,500 | $125,000 |

| Planet Home Lending, Llc Meriden, CT |

101,716 | $29,506,870,000 | $220,000 | $81,750 |

| Carrington Mortgage Services, Llc Anaheim, CA |

92,949 | $19,561,955,000 | $166,000 | $82,000 |

| Network Capital Funding Corporation Irvine, CA |

92,108 | $27,632,370,000 | $309,250 | $164,000 |

| American Financing Corporation Aurora, CO |

84,544 | $21,189,570,000 | $261,500 | $70,250 |

| Dhi Mortgage Company, Ltd. Austin, TX |

83,519 | $24,442,415,000 | $283,500 | $110,000 |

| Homebridge Financial Services, Inc. Iselin, NJ |

80,664 | $29,176,500,000 | $361,500 | $123,750 |

| American Financial Network, Inc. Brea, CA |

77,082 | $24,700,905,000 | $319,666 | $107,333 |

| Keybank National Association Cleveland, OH |

75,683 | $30,868,805,000 | $325,000 | $158,200 |

| Citibank, National Association Long Island City, NY |

73,707 | $50,381,545,000 | $622,800 | $320,200 |

| Paramount Residential Mortgage Group, Inc. Corona, CA |

73,308 | $22,501,770,000 | $301,333 | $110,200 |